Irs Estimated Tax Payment Voucher 2024

Irs Estimated Tax Payment Voucher 2024. Information you’ll need your 2023 income tax return. If you expect to owe at least $1,000 in taxes, after all deductions and credits, and your withholding and credits are expected to be less than the calculated number—in this.

You can pay the complete amount by september 15 or split it into. There are four payment due dates in 2024 for estimated tax payments:

2024 Form 1040Es Payment Voucher 3 Dodie Freddie, If Your Name, Address, Or Ssn Is Incorrect, See Instructions.

Information you’ll need your 2023 income tax return.

You Can Pay The Complete Amount By September 15 Or Split It Into.

Direct pay with bank account.

Irs Estimated Tax Payment Voucher 2024 Images References :

Source: philliewelayne.pages.dev

Source: philliewelayne.pages.dev

2024 4th Quarter Estimated Tax Payment Gabey Shelia, Irs quarterly tax payment forms 2024. What are estimated tax payments?

Source: paulitawinna.pages.dev

Source: paulitawinna.pages.dev

Ca State Estimated Tax Form 2024 Barb Marice, Irs quarterly tax payment forms 2024. Sign in to make a tax deposit payment or schedule estimated payments with the electronic federal tax payment system (eftps) enrollment required to use this option.

Source: found.com

Source: found.com

2024 Tax Deadlines for the SelfEmployed, This interview will help you determine if you’re required to make estimated tax payments for 2024 or if you meet an exception. What are estimated tax payments?

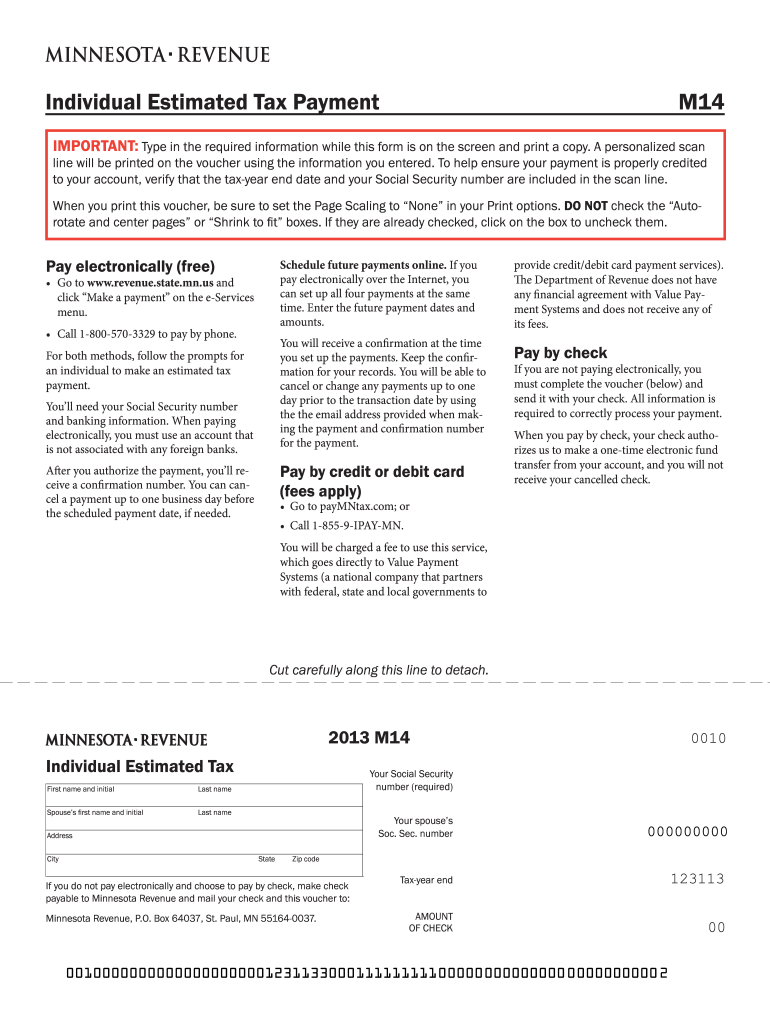

Source: www.dochub.com

Source: www.dochub.com

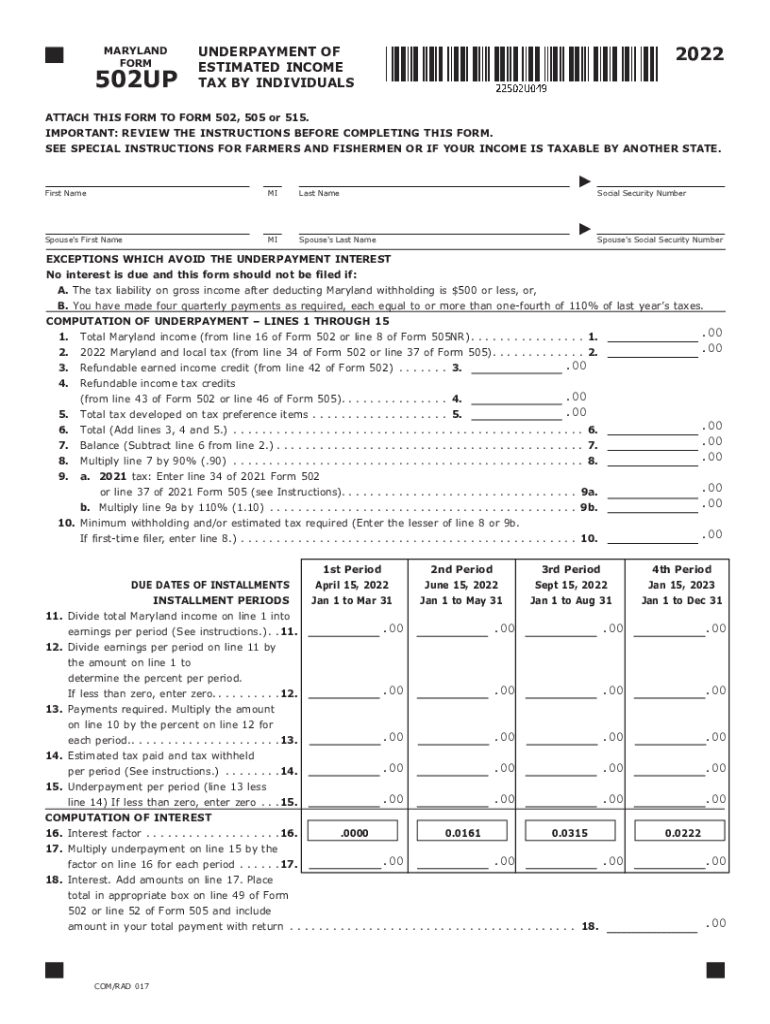

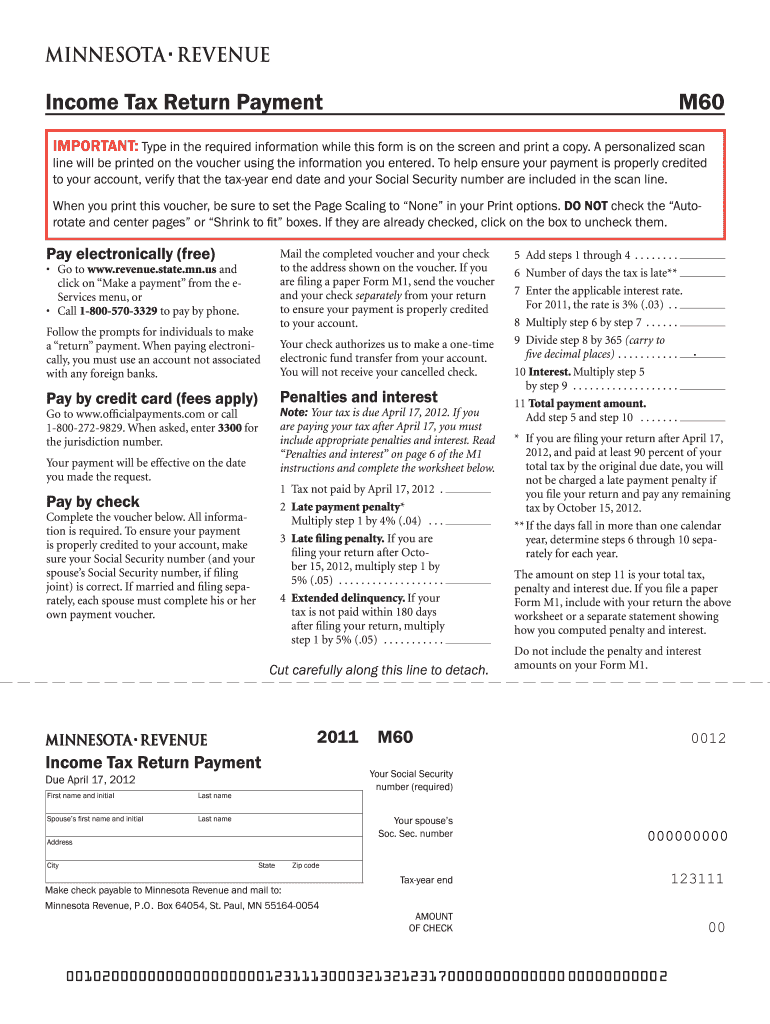

Minnesota estimated tax Fill out & sign online DocHub, To figure your estimated tax, you must figure your expected agi, taxable income, taxes, deductions, and credits for the year. Irs quarterly tax payment forms 2024.

Source: www.templateroller.com

Source: www.templateroller.com

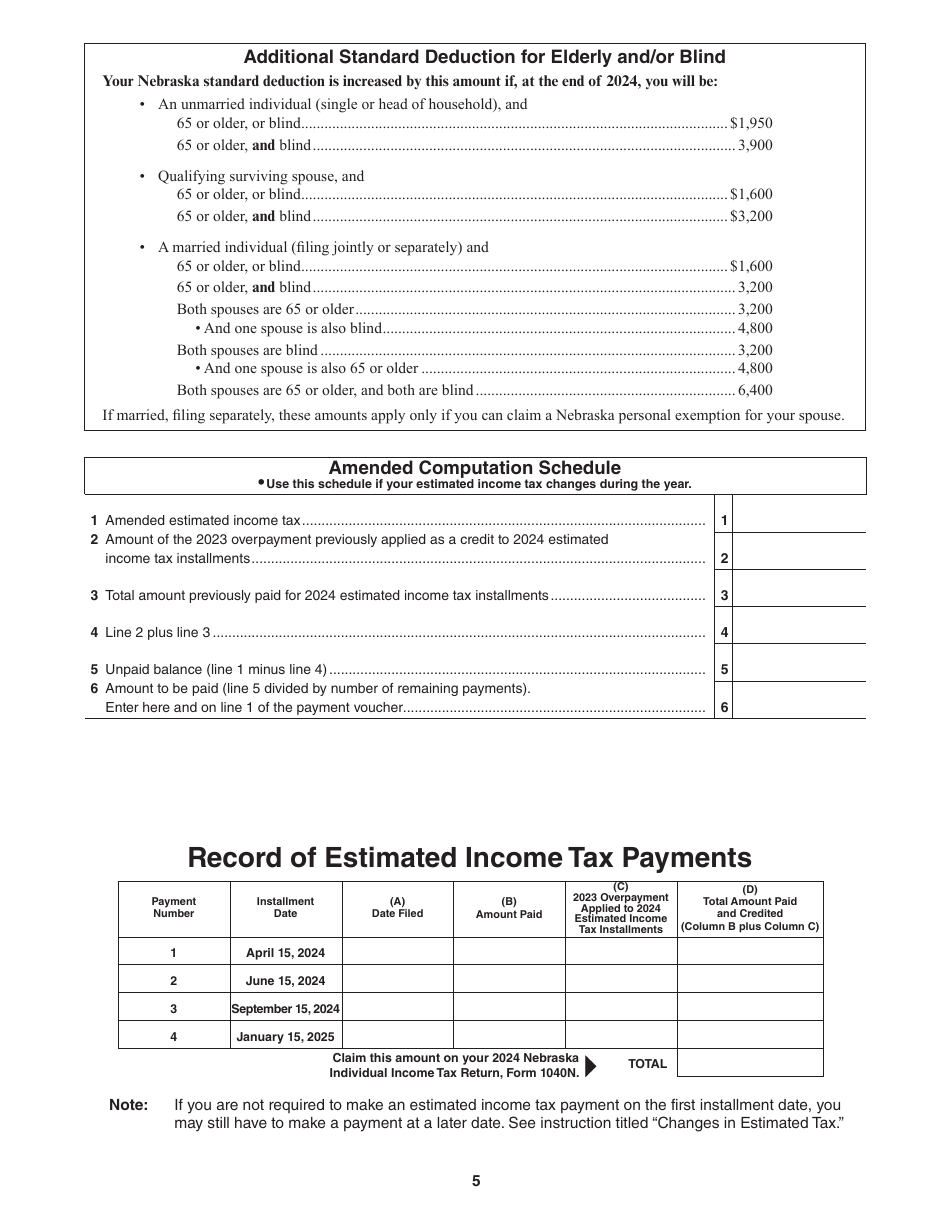

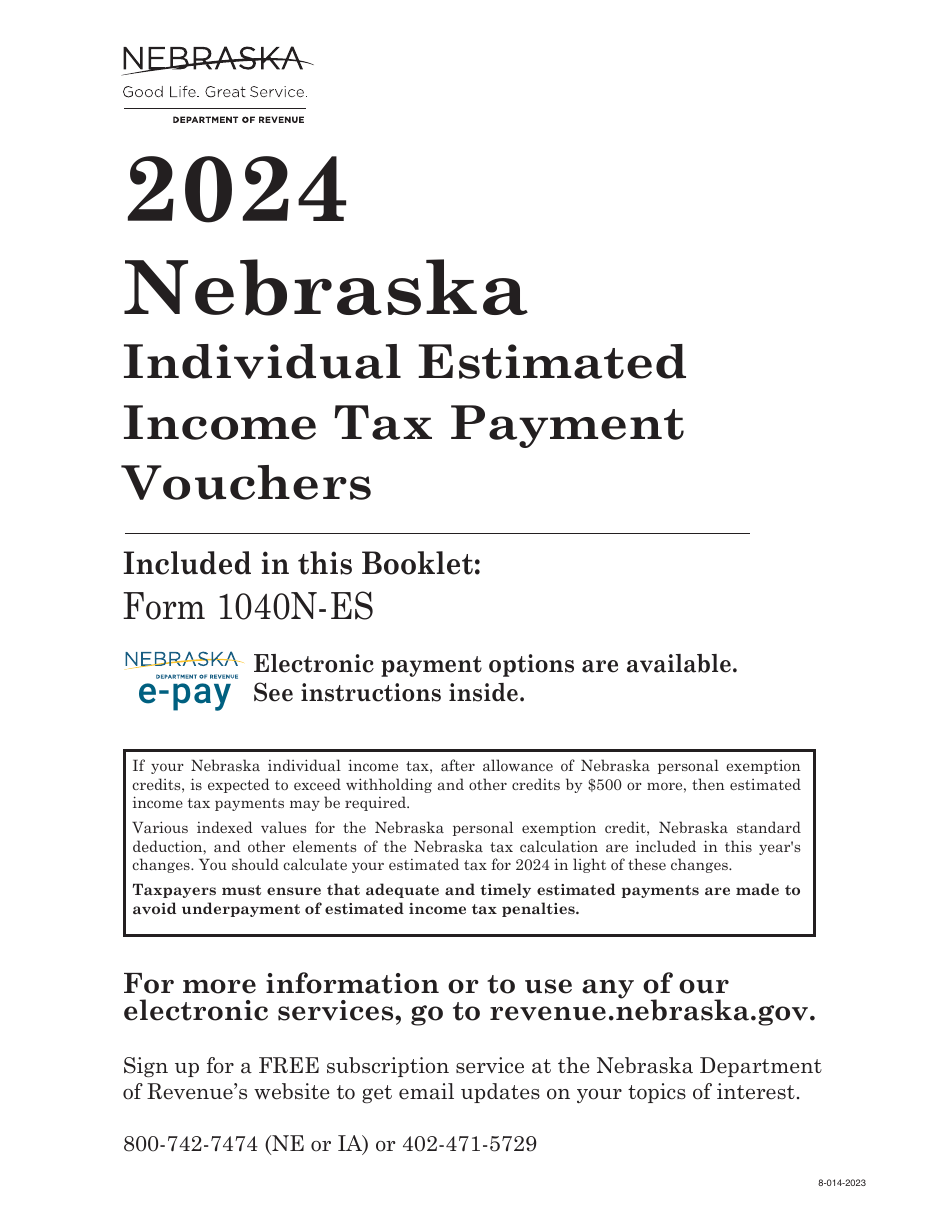

Form 1040NES Download Fillable PDF or Fill Online Nebraska Individual, A payment voucher is a way to record payments made to suppliers. Direct pay with bank account.

Source: www.templateroller.com

Source: www.templateroller.com

Form 1040NES Download Fillable PDF or Fill Online Nebraska Individual, 2024 4th quarter estimated tax payment gabey shelia, by turbotax• 1299•updated january 15, 2024. Further, reduce the tax deducted at source, or collected at source.

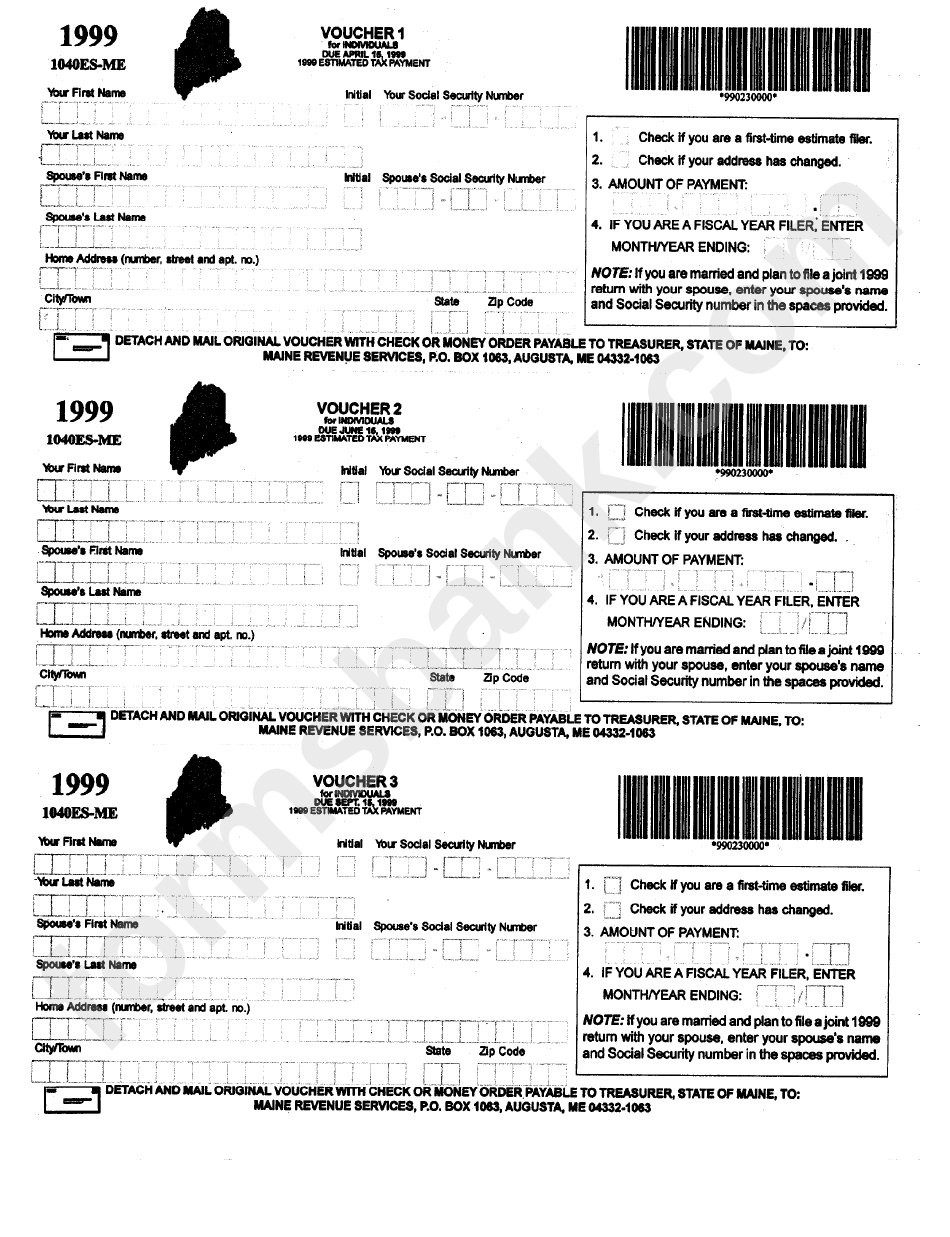

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Form 1040esMe Voucher 1 For Individuals Estimated Tax, In this article, we'll go over everything you need to know about missing a quarterly estimated tax payment — including what the penalties are and how to potentially get out of them. Final payment due in january 2025.

Source: jainebquintilla.pages.dev

Source: jainebquintilla.pages.dev

Estimated Tax Payments 2024 Due Irs Tessi Quentin, Make tax deposits, estimated taxes, offer in. By turbotax• updated 3 months ago.

Source: rebecawbarbey.pages.dev

Source: rebecawbarbey.pages.dev

Where Do I Mail My Irs Estimated Tax Payment 2024 Gipsy Kaitlin, When figuring your 2024 estimated tax, it may be. Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

I am unable to print the estimated tax payment cou…, Estimated tax payments are the taxes you pay to the irs. This form is typically used with.

Information You’ll Need Your 2023 Income Tax Return.

Make payments from your bank account.

If You Earn Taxable Income In August 2024, You Don’t Have To Pay Estimated Taxes Until September 16, 2024.

What are estimated tax payments?

Category: 2024